pa tax payment forgiveness

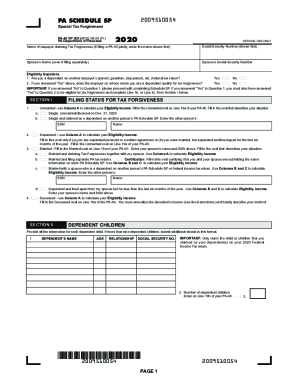

Solved Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Pennsylvania Department Of Revenue Depending On Your Income And Family Size You May Qualify For A Refund Or Reduction Of Your Pennsylvania Income Tax Liability With The State S Tax Forgiveness Program

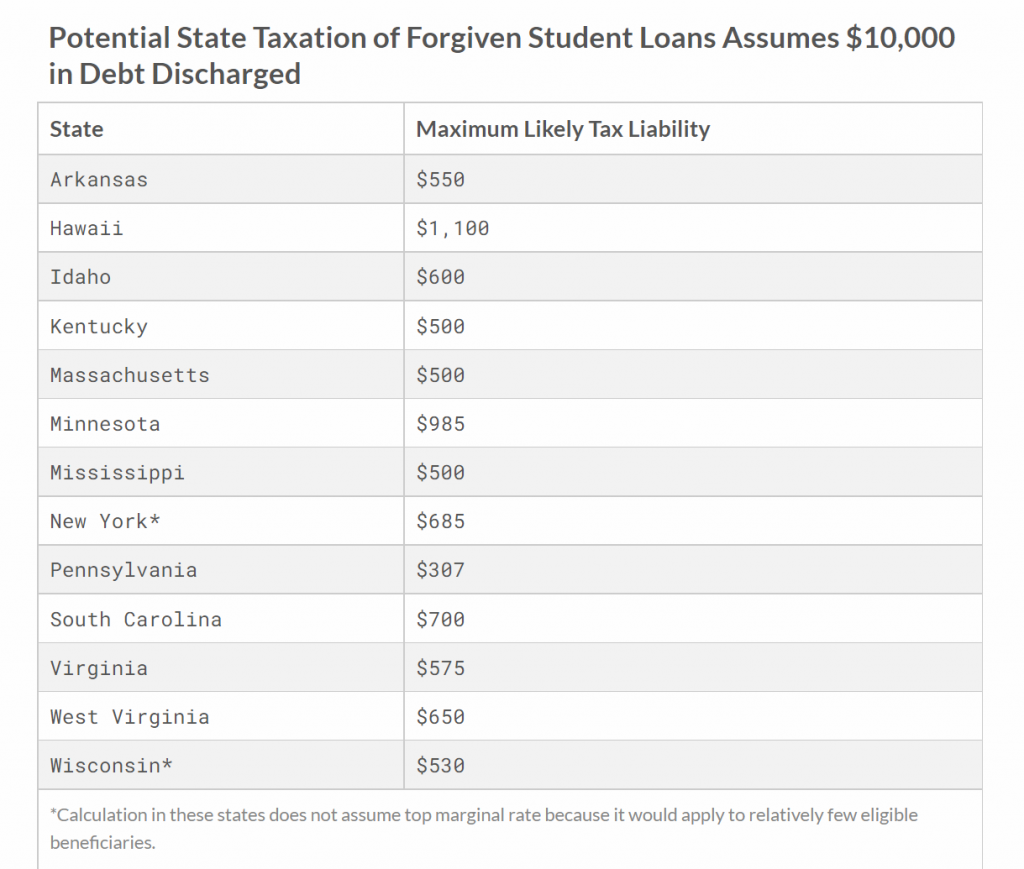

If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate.

. Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. For example a family of four couple with two dependent. Generally such loan payments or forgiveness are not subject to Pennsylvania personal income tax unless the student provides services directly to the payor or lender in.

Pennsylvania is not one of them Governor Tom Wolf says. Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income. Student loan forgiveness is not considered taxable income at the federal level and the governors action removes an immense burden from student borrowers who receive loan.

Provides a reduction in tax liability and Forgives. Heres how much state taxes could cost you. Provides a reduction in tax liability and.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. The Hill Residents of 12 states not including Pennsylvania who receive debt forgiveness from the federal government for their student loans may need to pay some state. Pennsylvania has not been taxing student loan.

To claim this credit it is necessary that a taxpayer file a PA-40. However any alimony received will be used to calculate your PA Tax Forgiveness credit. What Is Tax Forgiveness In Pa.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Wolf notes that for a public service worker with 50000 in forgiven student loans in Pennsylvania will now be able to avoid a 1535 state income tax bill. Seven states might tax borrowers on student loan forgiveness.

Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania.

Pa Breast Cancer Coalition On Twitter Doing Your Taxes Donate Your State Income Tax Refund To Pa Breastcancer Research Find A Cure Now So Our Daughters Won T Have To Https T Co Mmw2gqer9y Twitter

Pa Schedule Sp Form Fill Out And Sign Printable Pdf Template Signnow

These 13 States Consider Student Loan Debt Forgiveness Taxable Income Cpa Practice Advisor

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

Gov Wolf Forgives State Taxes From Student Loan Forgiveness For Public Servants Wjet Wfxp Yourerie Com

These States Are Waiving State Taxes For Student Loan Forgiveness

Don T Pay Sales Tax For Home Improvements Ny Nj Pa

Pa Dept Of Revenue Encourages You To Use Electronic Filing Options To File State Income Taxes Fox43 Com

Fillable Online 2000 Pa Schedule Sp Special Tax Forgiveness Credit Pa 40 Sp Forms Publications Fax Email Print Pdffiller

Irs To Wipe Away 1 2 Billion In Late Fees From Pandemic Bloomberg

Gov Wolf Student Loan Forgiveness Will Not Be Taxed In Pennsylvania The Philadelphia Sunday Sun

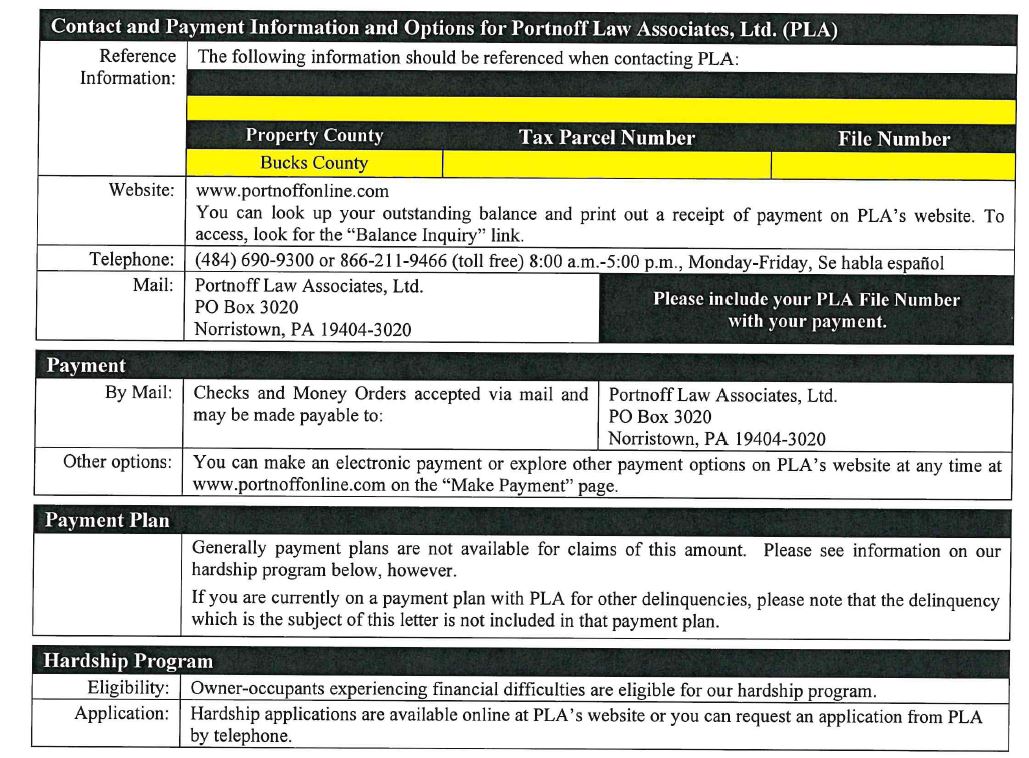

Tax Collection Warminster Township

Small Business Loan Forgiveness Will States Tax Sba Ppp Loans

Pennsylvania Department Of Revenue On Twitter Happy Nationalretroday Here S A Look At The Department Over The Last Few Decades The First Tax Update Was Published In 1983 And Continues To Be Published

Pennsylvania Department Of Revenue Many Pennsylvanians Who May Be Eligible For A Refund Or Reduction Of Their Pennsylvania Personal Income Taxes Will Be Receiving Letters In The Mail In The Coming